What is Credit Card?

A Credit Card is a type of payment card in which charges are amde against a line of credit instead of the account holder’s cash deposits. When someone uses a Cr. Card to make a purchase, that person’s account accrues a balance that must be paid off each month. Although failure to pay off the Credit Card on time could result in interest charges and late fees, credit cards can also help users build a positive credit history.

History Of Credit Card

“McNamara devises a new way to pay bills”

The concept of credit is not a new one. The word “credit” comes from the Latin word credo. To believe or trust, and we know that the Egyptians were using credit methods over 3,000 years ago.

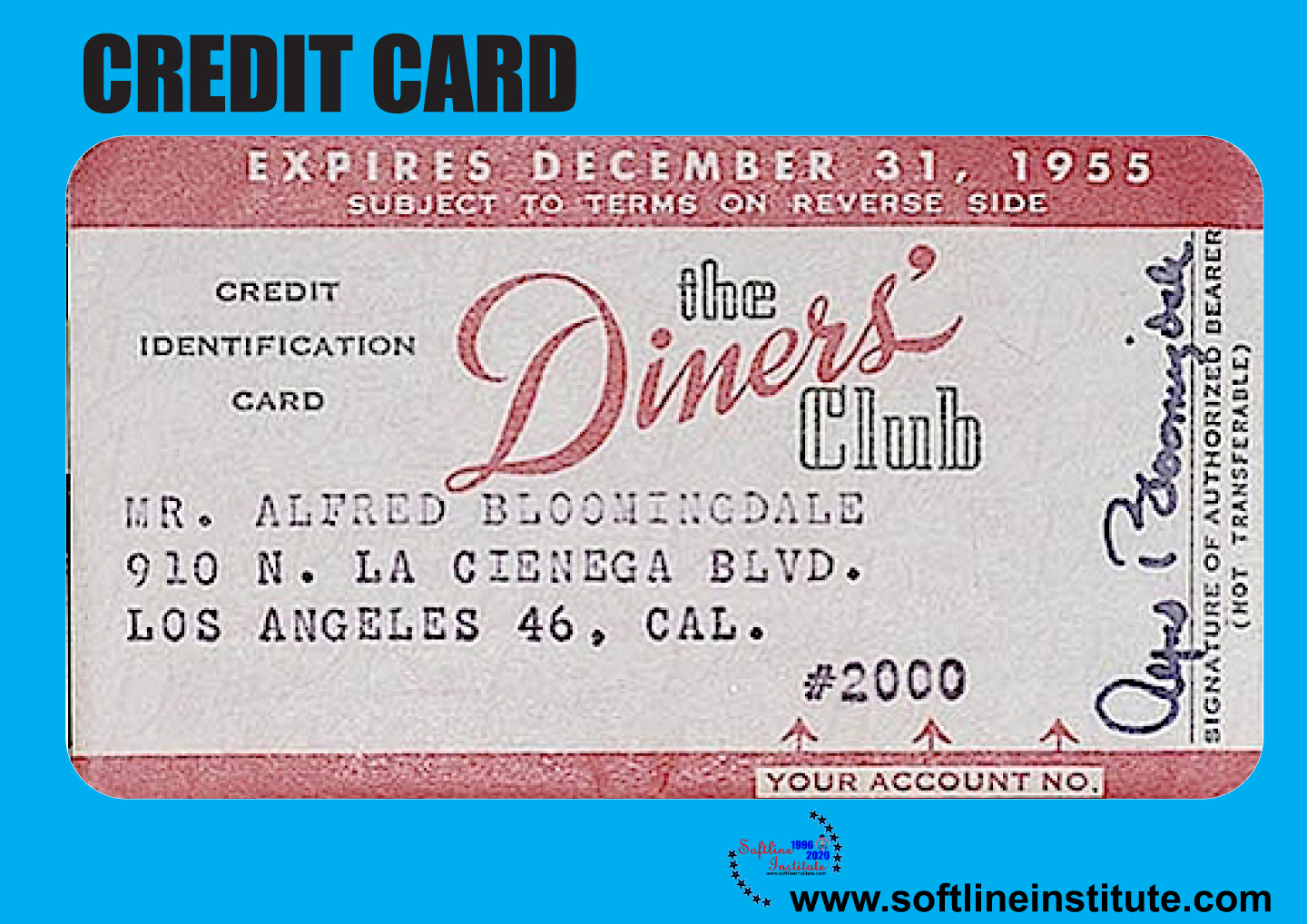

The Credit Card is a system of payment and is named after the plastic card issued to people who subscribe to the system. although the term was used several times in Edward Bellamy’s 11887 novel Looking Backward, and Western Union issued charge cards to users from 914, the modern credit card was not invented until 1949. It is said that Frank X. McNamara, a New York banker, came up with the idea after forgetting his wallet when out entertaining clients.

Modern Credit Cards, where the issuer lends money to the consumer to be paid t the merchant, evolved quickly. In 1958 the Bank of America created the first card to be made available to the mass market. Bank Americard evolved into the Visa system, and MasterCard was established in 1996 by a group of credit-issuing banks. Arriving in the postwar boom period of growth, thecar d system was embraced wholeheartedly by developed countries.

Recently, alarm has begun to grow that the credit system in developed countries is out of control. The United Kingdom alone was facing a consumer debt of one trillion pounds sterling in 2004. McNamara’s system, more than just a convenience, has changed the way we interact with money forever.

ADVANTAGES AND DISADVANTAGES OF CREDIT CARD

ADVANTAGES/BENEFITS

1. Easier to make big-ticket purchases

Purchase high-end products using the Credit Card and convert the amount into easy, manageable EMIs.

2. Accumulate Reward Points

The Bajaj Finserv RBL Bank SupeCard brings attractive reward points with almost every transaction. Redeem these points for exclusive discounts, gift vouchers, cashback, etc.

3. Increase Your Credit Score

Payment of Credit Card bills within the due date every month increases your CIBIL score significantly. A good credit profile can qualify you for a loan or a new card in the future.

4. ATM cash withdrawal with 0% interest

The Bajaj Finserv RBL Bank SuperCard allows you to make cash withdrawals from ATMs with no interest for up to 50 days. Meet your cash needs instantly and repay later easily.

DISADVANTAGES/DRAWBACKS

1. High Rates of Interest

Failing to pay off the outstanding dues on your credit cards within the due date incurs high-interest rate. You can avoid paying additional interests by making timely repayments every month.

2. Overspending

The ease of using credit cards often leads to overspending. This can create a financial mess and also your credit profile negatively. Try to keep the credit utilization rate below 50% of the total available limit.

Be responsible with its usage to enjoy the advantages of a credit card and save more on your expenses effectively.

For More Help: